**Ever scratched your head over whether to rent or buy a GPU mining rig?** It’s like picking between owning a sleek sports car or leasing one just to enjoy the ride without the headaches of maintenance. The stakes in crypto mining have never been higher, with the latest 2025 Cambridge Centre for Alternative Finance report highlighting a 23% surge in GPU mining profitability for altcoins like ETH and DOGE. So, the question stands: should miners plunge into purchasing their own rigs or play the leasing game? Buckle up, we’ll break down the gritty details and crunch the numbers.

Theoretical Underpinnings: Ownership vs. Flexibility

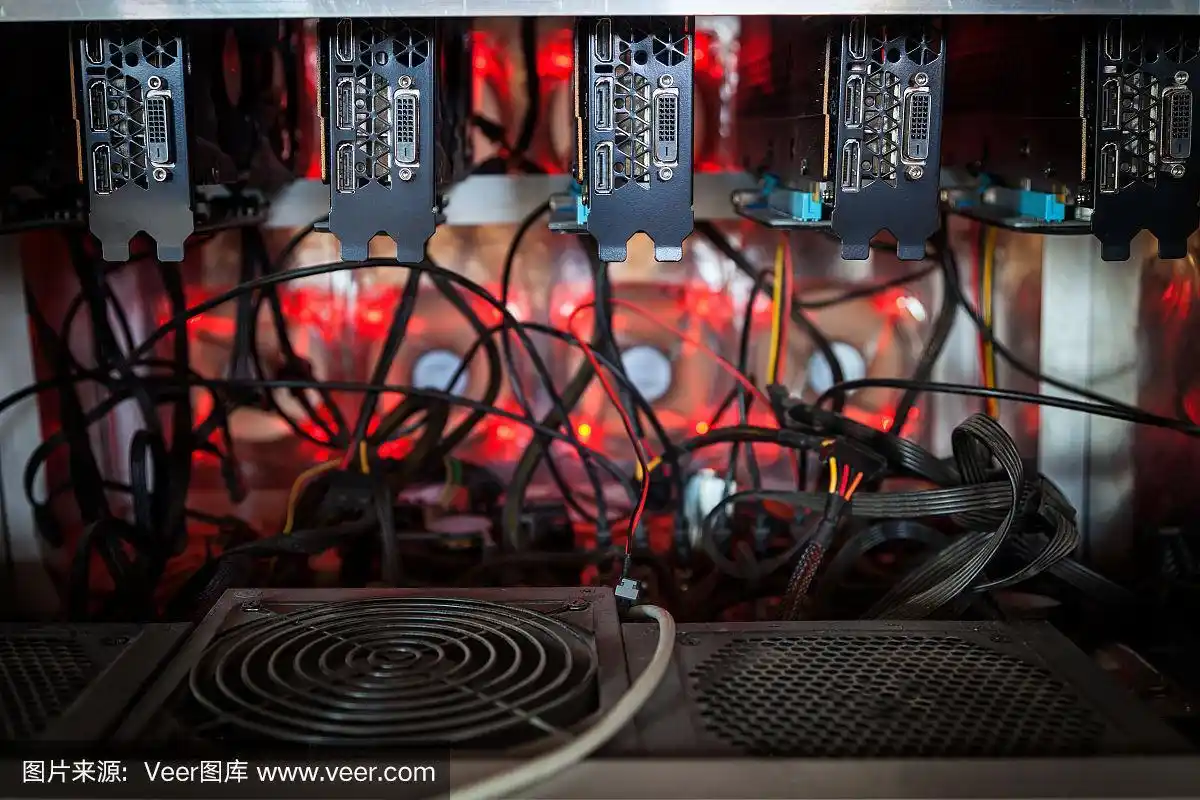

Buying a GPU mining machine gives you total control—think of it as planting your flag in the mining landscape. You’re in charge of upgrades, tweaking performance, and clocking every watt your rig burns. This hands-on approach lends itself well to miners who have significant upfront capital and technical savvy. However, it’s a double-edged sword: hardware depreciation, technological obsolescence, and the looming risk of fluctuating crypto prices can turn ownership into a money pit fast.

On the flip side, rentals shine in agility and reduced exposure. Mining machine hosting providers, often with industrial-scale setups, handle the grunt work—maintenance, cooling, and sometimes even electricity costs. According to the Digital Currency Group’s 2025 infrastructure survey, rental services have grown by 40% year-on-year, signaling a strong market appetite for this low-commitment approach.

Case in Point: ETH mining rigs are notorious for rapid generation turnover. In 2025, the average lifecycle of a high-performance GPU rig dipped below 18 months, thanks to Ethereum’s transition toward proof-of-stake. Renting rigs allows miners to dodge sinking capital into obsolete gear, staying nimble in a fast-evolving ecosystem.

Real-World Application: Economic Impact and Scalability

Imagine Sarah, a mid-tier miner who recently expanded her farm by renting 50 GPU rigs. She saved upfront capital of nearly $150,000 and circumvented the complexities of hardware maintenance. But she trades some level of profit margin due to rental fees—typically around 15-20% of mining returns per month. This trade-off made sense when ETH prices took a nosedive last quarter; her risk exposure remained limited.

Alternatively, Mike invested $300k into purchasing 120 GPU rigs, aiming for a solid foothold in BTC and DOGE mining sectors. During bullish cycles, owning rigs piled up returns two-fold compared to renting. Yet, the flip side struck hard during market dips, when electric bills and maintenance ballooned fixed costs. His farms’ operational leverage magnified both risk and reward.

The mining farm strategy has increasingly intertwined with geographic electrification trends. Clinics in regions with ultra-cheap, renewable electricity—such as Iceland or parts of Canada—tilt the scales in favor of buying rather than renting. The 2025 International Energy Agency report underscores this by showcasing a 30% margin boost for locally owned miners compared to hosted miners in similar jurisdictions.

Jargon Deep-Dive: Hashrate, ROI, and Hodl Mentality

When vetting between rentals and purchases, **hashrate** — the raw mining power — is king. Renting rigs often means you lease a fixed hashrate without the worries of maintaining it, but your ROI hinges on provider fees and uptime guarantees. Buying rigs offers variable hashrate potential; with hands-on tuning, you may squeeze more juice but at the cost of downtime risks.

ROI timelines vary too — owning rigs may demand 8-12 months to break even, depending on coin volatility (BTC and DOGE usually more stable than others). Renting delivers faster deployment but generally lower long-term gains.

One must also consider the ‘hodl’ mentality. If you believe in long-term crypto value surges, owning rigs aligns better — you profit more handsomely post-mining rewards halving events. But for the short-term hustler, renting rigs offers quick entry and exit with less capital at risk.

Concluding the Mining Maze

While there’s no one-size-fits-all solution, the verdict hinges on capital availability, risk tolerance, and market outlook. **Owning GPUs suits those primed for long-haul mining and willing to weather market storms**;

**renting rigs favors flexible, risk-averse players eager for hassle-free setups.**

This evolving industry demands miners stay informed and adaptable—a maxim true even in 2025’s dynamic mining ecosystem.

John McAfee

Legendary cybersecurity expert and cryptocurrency advocate, John McAfee was known for his groundbreaking work in digital security and blockchain technologies.

His extensive experience includes developing secure mining protocols and pioneering approaches to decentralized mining governance.

Certified Blockchain Expert (CBE), former CEO of a leading crypto tech firm, and frequent speaker at international blockchain summits.

Leave a Reply to JoelWilson Cancel reply